Great News: We are not affiliated with the TSP, Thrift Savings Plan, tsp.gov, frtib.gov, or any U.S. government agency or uniformed military services.

Over 3,000 Federal retirees live on more income, have less stress, and more security because of our Calculations.

There are no catches. It's not a "sales" call. There is no obligation to buy anything after. We simply do the Math no one has ever done for you before. It takes 45 minutes, and it may change your life. When it's done, you can of course leave.

We've helped people working in the departments & agencies listed below

ARMY

MARINES

NSA

NAVY

DHS

HHS

COAST GUARD

HUD

AIR FORCE

All

BEA

ITA

NIST

NOAA

NTIS

ERIC

IES

DOL

DOS

DOT

TREASURY

DOI

DOJ

DOL

DOS

A question for retired Federal employees

Most retired Federal employees withdraw from their TSP. They do that because they want to live on more income than their Pension and Social Security provides.

Will you keep it in Federal Funds like the G, C, S, L, or F?

What if the fund you choose earns less than you take out?

What if you choose the wrong fund one year?

What if the market crashes?

Inflation, risk — what about those things?

Enter retirement without a plan, and you’ll answer these questions every year.

It doesn’t have to be like this…

INTRODUCING, TSP RESCUE PLAN'S

RETIREMENT STRATEGY SESSION

A Free 45-minute Zoom call, that shows you:

How to structure your TSP To Grow More Than You Withdraw Each Time You Withdraw

Regardless of market conditions

-

There are no "catches" or "tricks" involved during a Retirement Strategy Session. It is not a "sales" call. There is no hidden obligation to buy anything after your Retirement Strategy Session is complete. We simply do the Math no one has ever done for you before. It takes 15 minutes, and it may change your life. When it's done, you can of course leave.

Here's How It Works

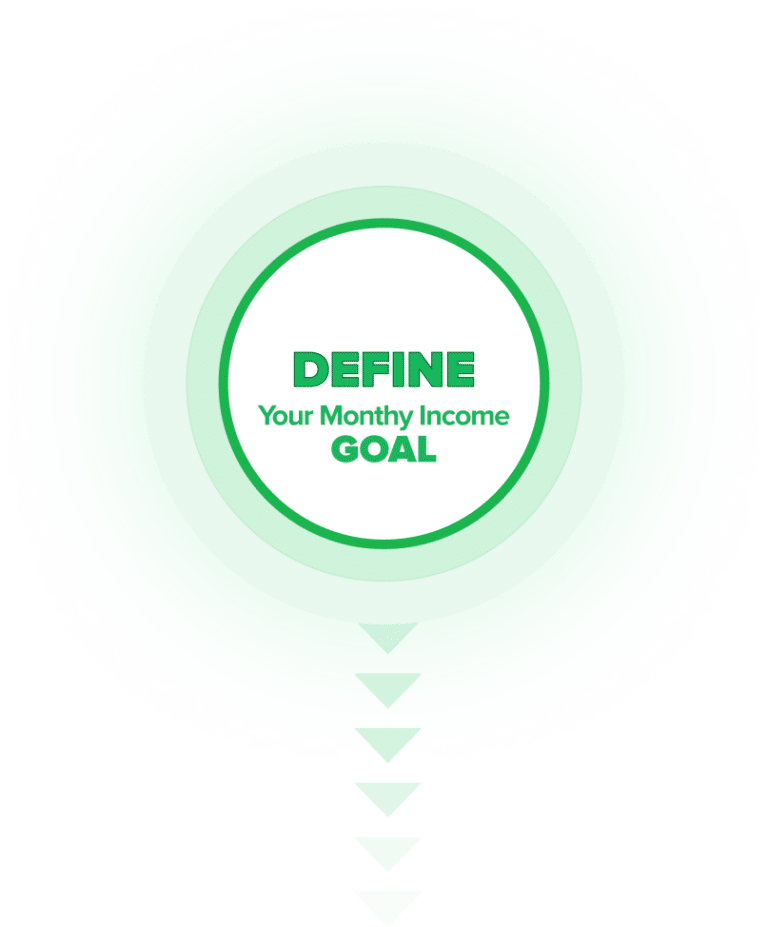

STEP 1

We help you figure out exactly how much more you need

Your Retirement Counselor’s first job is to calculate how much monthly income you’re on track to get from your Pension and Social Security payments.

Their second job is to help you figure out how much more income — above those payments — you want to have coming in each month.

STEP 1

We help you figure out exactly how much more you need

Your Retirement Counselor’s first job is to calculate how much monthly income you’re on track to get from your Pension and Social Security payments.

Their second job is to help you figure out how much more income — above those payments — you want to have coming in each month.

They'll ask many questions to understand all facets of your financial situation...

- Do you plan on making big habit changes post retirement?

- Any big expenses planned?

- How much do you want to leave your heirs?

- What are your goals, dreams, & hopes?

- Now is the time to lay everything out on the table...

STEP 2

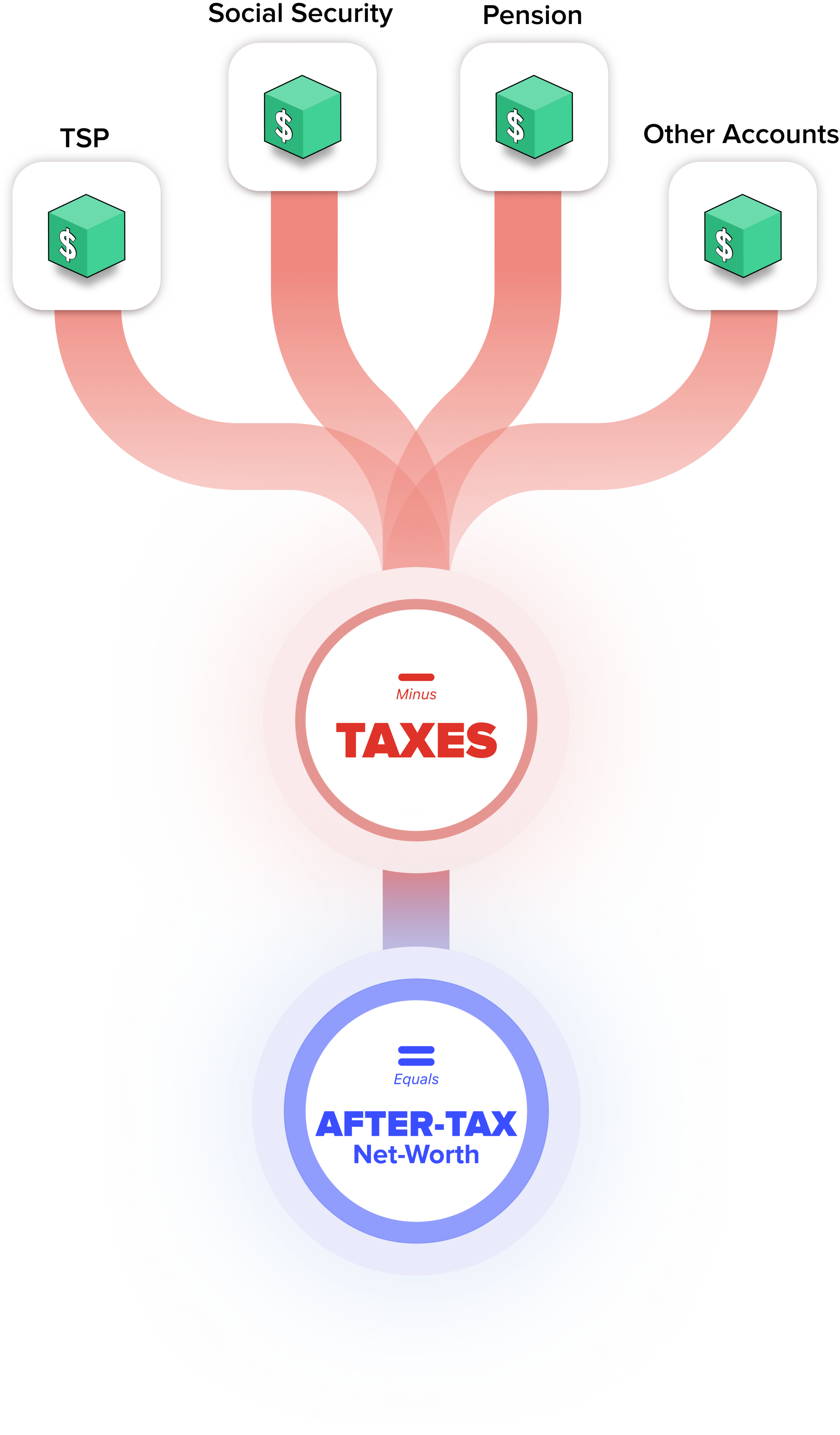

Our App Calculates Your Future After-Tax Net Worth

You now have an Income Goal & know exactly how much more income is needed to hit it your goal.

There’s only one way to do that: by putting every penny in your net-worth to work.

STEP 2

Our App Calculates Your Future After-Tax Net Worth

You now have an Income Goal & know exactly how much more income is needed to hit it your goal.

There’s only one way to do that: by putting every penny in your net-worth to work.

Your Retirement Counselor adds up the value of...

- Your TSP's total value…

- Non-government pensions

- Non-government benefits

- Any 401(k)s, IRAs or other Financial accounts you have...

Then, they'll subtract...

- The future tax you’ll owe on each

Now you and they know, dollar-for-dollar, how much you actually have to put to work and bring in your income goal.

For the first time, maybe in your life, you find out exactly how much of your TSP and Other Financial Assets you get to keep vs pay in taxes.

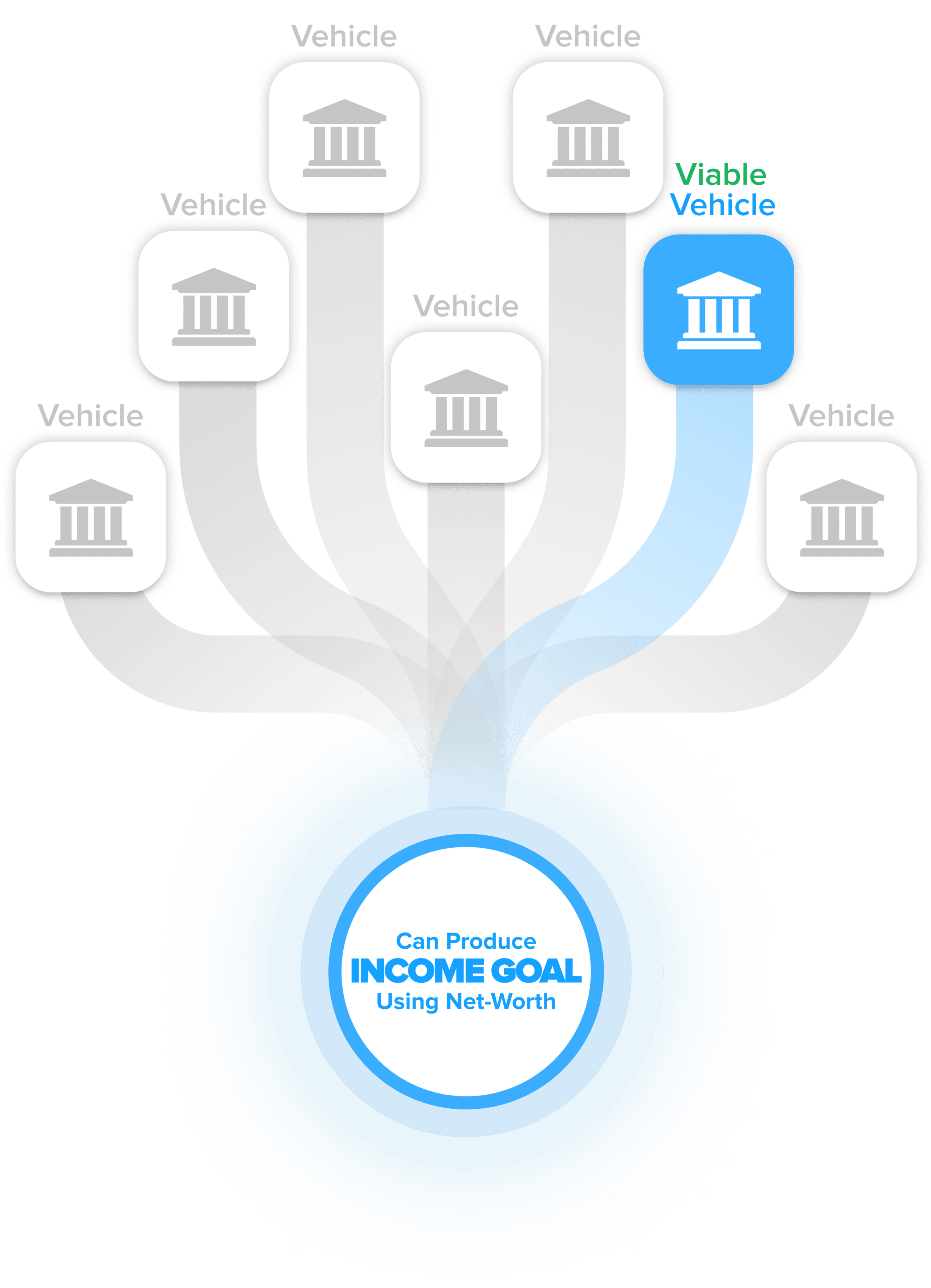

STEP 3

Our App Reveals: Which Vehicles Can Produce Your Goal Income Using Your Net-Worth, WHILE Growing it

3,000+ Federal employees have used our App. On average it finds 1-3 Vehicles that can produce your income goal, using your net-worth—while growing it. Sometimes, it finds more. Others, less.

And your Retirement Counselor shows you how each vehicle works.

STEP 3

Our App Reveals: Which Vehicles Can Produce Your Goal Income Using Your Net-Worth, WHILE Growing it

3,000+ Federal employees have used our App. On average it finds 1-3 Vehicles that can produce your income goal, using your net-worth—while growing it. Sometimes, it finds more. Others, less.

And your Retirement Counselor shows you how each vehicle works.

Our App only looks for vehicles that meet our 3-Point Criteria

- It must produce your income goal — for life while, at the same time;

- It must guarantee: you will never lose money while, at the same time;

- It must have Zero Market-Risk

We've helped over 3,000 Federal employees

Here's What A Few are

saying

Retired/Active: Retired 4 years

Retired/Active: Retiring in 6 mo/.

Retired/Active: Retiring in 2 years.

Retired/Active: Retired for 3 years.

Retired/Active: Retiring in 2 years.

Frequently Asked Questions

What is Retirement Math?

How to make your TSP or other accounts GO UP in value, MORE than you withdraw from them, EACH TIME you withdraw from them.

How does a Retirement Strategy Session work?

It’s a Zoom call between you and a TSP Rescue Plan Retirement Counselor.

On the call, your Retirement Counselor shares their screen, opens the TSP Rescue Plan Forecasting App, then takes you through the 3 steps below:

- Calculate Your Monthly Retirement Income Goal:

Most retired Govt. employees live on more than Pension and Social Security payments. We assume, you’ll want to do the same. Your Retirement Counselor’s first job is to figure out how much more you specifically will need. They’ll ask you many questions and input your answers into our Forecasting App. - Calculate Your Total After-Tax Net-Worth:

Your Retirement Counselor adds up the value of all financial assets in your net-worth (your TSP + other accounts) and subtracts future tax you’ll owe for each. This big, round number is what our app will use to complete step 3. - See Which Financial Vehicles Can Produce Your Income Goal, Using Your Net-Worth, While Growing it, Without Risk.

On your screen, you’ll see our Forecasting App show you all available Financial Vehicles that can produce your Monthly Retirement Income Goal — using the data you gave in Steps 1 & 2.

How can I tell if I need this?

Asks yourself these questions. Then consult the green box below:

- Do you know exactly how much income your Pension and Social Security will bring in each month?

- Do you think you'll need (or want) more than that?

- What assets will you withdraw from to get that income?

- Have you calculated the tax you'll owe when you withdrawing from those assets?

- Have you re-structured as many of those assets as possible to decrease taxes?

- Are your assets structured to grow, or at least maintain value, as you take income out?

- Even if the market crashes?

- Even if there's a recession or worse: a depression?

If you said no to any, then we believe a Retirement Strategy Session will help you. Below is our reason why:

On it, you’ll learn how to do everything above.

Why are Retirement Strategy Sessions Free?

They aren’t free. If this page says they are, it means some free spots are left.

We believe every Govt. employee should experience a Retirement Strategy Session. Every other month, we give away 30-40 spots for free.

How much does a Retirement Strategy Session cost if free spots are full?

Retirement Math Sessions are: $200.00.

Sometimes Retirement Strategy Sessions go for longer than 1 hour. Answering questions, or explaining a technical thing can add up. If this happens you will not be charged extra.

What's your return policy and/or guarantee?

A Retirement Strategy Session is $200.00.

You’ve likely never paid for or experienced anything like a Retirement Strategy Session before. Which is why we’ve attached our famous “Before, During, And Lifetime After” 100% Money-Back Guarantee:

If, you’re not satisfied at any point before your Retirement Strategy Session, simply send an email to cancel@tsprescueplan.com & we’ll send you a full refund—no questions asked.

If, you’re not satisfied at any point during your Retirement Strategy Session, simply interrupt your retirement counselor mid-sentence and say, “I am not amazed!” He or she will send you a full refund immediately—no questions asked.

If, you’re not satisfied at any point after your Retirement Strategy Session, simply call or email your Retirement Counselor. They will send you a full refund immediately—no questions asked.

Are there any catches?

Yes. There may be one — in Step 3.

A Retirement Strategy Session has 3 Steps. In Step 3, you’ll see which available Financial Vehicles can produce your Monthly Retirement Income Goal — using the data you gave in Steps 1 & 2. Eg: in steps 1 & 2, we “collect your data.” In Step 3, our app “uses your data” to comb through many different financial vehicles available on the market today.

The “catch” is this:

If you would like our help re-structuring your assets as our App shows you in Step 3, it may take us up to 3 months to complete — from start to finish.

We’re a very small team.

What is Step 3? Go to Step 3.

Do I have to send you any financial documents?

No. We will not ask you to send us any financial documents. Ever.

During Step 1 and 2, your retirement counselor asks you around 100 questions to better understand your situation, so they can help you find a solution. They then input your answers into TSP Rescue Plan’s Forecasting App (which is visible to you via our screen share).

Examples of questions we WILL ask:

- How much do you spend each month on bills, mortgages & expenses?

- Is that how much you want to spend on expenses when you retire?

- How many years are left until you retire?

- What state do you live in?

- How much do you make each year?

- How much are you contributing to your TSP?

- What Federal Funds is your TSP allocated to?

- How much of your TSP is allocated to the G-Fund

Examples of questions we will NEVER ask:

- We will never ask for any account numbers.

- We will never ask for your social security number

- We will never ask for your address or any other personally identifying piece of information.

Why are Retirement Strategy Sessions held on Zoom?

One reason: because we want to share our screen with you.

We want to share our screen because we want you to see our Forecasting App as your Retirement Counselor uses it.

They will ask you questions, then enter your answers into our Forecasting App. We call your answers, “data-points.”

Our App is connected to every major U.S. Financial API. As each data-point is entered, our App examines thousands of financial vehicles and calculates whether each can produce your Income Goal using your after-tax net worth that was calculated in Step 2.

You seeing all of this happen on your screen, live, in real-time, is the entire point of a Retirement Strategy Session.

A likely reality: no one’s ever done anything like this for you before.

I don't need to "plan anything" if my net worth is over $10,000,000 right?

OPINION: we would answer, “No! Incorrect!”

It doesn’t matter if your net worth is $10,000,000 or $40,000.

If, every month in retirement, you plan on spending more income than your Pension and Social Security brings in, you should have a plan for:

A likely reality: no one’s ever done anything like this for you before.

- Where that supplemental income will come from.

- Making sure wherever you’re taking that income from is always growing, not shrinking — as you take from it.

- Making sure your heirs pay the least taxes on inheritance (should be close to zero).

- Making sure you pay the least taxes each time you withdraw income (should be exactly at or close to zero as possible).

- Making sure your heirs inherit as much as possible (should be 2-3x more than you began retirement with)—despite spending a significant amount on yourself

How long is the Retirement Strategy Session?

Your Retirement Strategy Session will last at least 45 minutes.

Sometimes they run for longer. Answering questions, or explaining a technical thing can add up! And we encourage questions.

Will you give me financial advice?

No and to be frank, we seriously dislike “financial advice.” Here’s why.

Everyone comes to us with the same retirement goal:

You want to use the assets in your net-worth, to produce the same income as when you were on Federal salary WHILE SIMULTANEOUSLY making sure the total value of the assets you’re taking that income from GOES UP, not down.

Taking money out of your TSP / Other financial accounts is easy. Making your net-worth INCREASE as you simultaneously withdraw from it… That’s harder.

Most Federal employees — heck, most people — don’t know HOW to do that ⬆︎.

Not knowing HOW to do something, is why you would seek “advice”.

The problem with taking advice, when you don’t know HOW to do something, is you must TRUST the person giving it.

That is why our service exists. We dislike advice & don’t give it. Because of that, you do not need to trust us.

Instead we simply show you HOW to achieve your goal—in 45 minutes. It takes 3 steps.

- We help you set an income goal

- We calculate your total after-tax net worth

- We show you which vehicles can produce your goal income using your net-worth, while growing it.

By the end of a Retirement Strategy Session, the “best” financial vehicle will be self evident.

No trust or advice needed.